By Trevor Hammond

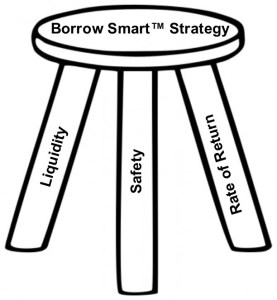

Whenever I am conducting a consultation with a new home buyer, I like to introduce what I call, the “3-Legged Stool”. This becomes a crucial thinking tool for making smart home buying and investment decisions as it relates to your hard-earned money!

The three “legs” are: Liquidity, Safety, and Rate of Return. These are the three key filters for making all investment decisions, whether it’s what to do with $100 left over at the end of the month, or deciding between 10% versus 20% down payment to buy that new house.

Let’s start with liquidity. This means, how easily accessible is my money

when I put it somewhere? We all understand that money in a savings or checking account is extremely “liquid”, meaning I could drive to the closest ATM machine and get some of it within minutes. Money in a retirement account, on the other hand, is a bit harder to get to, thus there is less “liquidity”. But how about money used for the down payment on a house? How easy is it to get some of that money back out should you ever absolutely need it? The short answer is, there are only two ways to access home equity – sell, or borrow (refinance or a home equity line of credit). Either of these can take from two weeks up to two months, depending on your situation and the market. Thus, it is critical for home buyers (and homeowners) to understand that equity in a home has the least amount of liquidity when compared to other investments. So be smart when deciding how much to put do wn or when/if paying extra each month toward your mortgage payment.

wn or when/if paying extra each month toward your mortgage payment.

Now, on to safety. The second “leg” of the stool refers to, “How likely will my money be there when I need it?” How safe is the equity in your home compared to other investments? Equity is defined as the difference between how much you owe (mortgage) and how much your house is worth (purchase price). While there are a number of ways you can lose the equity in your home that we discuss in our custom BorrowSMART Consultation™, the short answer is that home equity is considered pretty safe. I often compare it to putting money into a long-term bond…not easily accessible but relatively safe.

Finally, the rate of return must be considered. This refers to how much, or how little

Finally, the rate of return must be considered. This refers to how much, or how little

interest you can expect to enjoy when investing your money somewhere. While stocks tend to be considered riskier investments, people balance that risk with the likelihood of a better rate of return over time. On the other hand, your checking or savings account offers a very low rate of return. But what rate of return does the equity in your home provide? To keep this letter brief…0%. Equity in a home earns zero rate of return…forever. By paying down a mortgage faster, or making a larger down payment, you do indeed SAVE interest. Just keep in mind when you decide to “store” a lot of money inside your house in the form of “home equity”, that the only ongoing rate of return will be based on the value of your house.

I know this is brief and a high overview of our BorrowSMART™ strategies we help our clients with, but please reach out if you have questions or would like to learn more. Our passion is helping homeowners, and new home buyers make smarter decisions when financing real estate. We do this through a very unique process that helps you understand money at a higher level, and then apply this greater understanding to your important real estate financing decisions. The result…a Bigger, Better Future™ for you and your family!